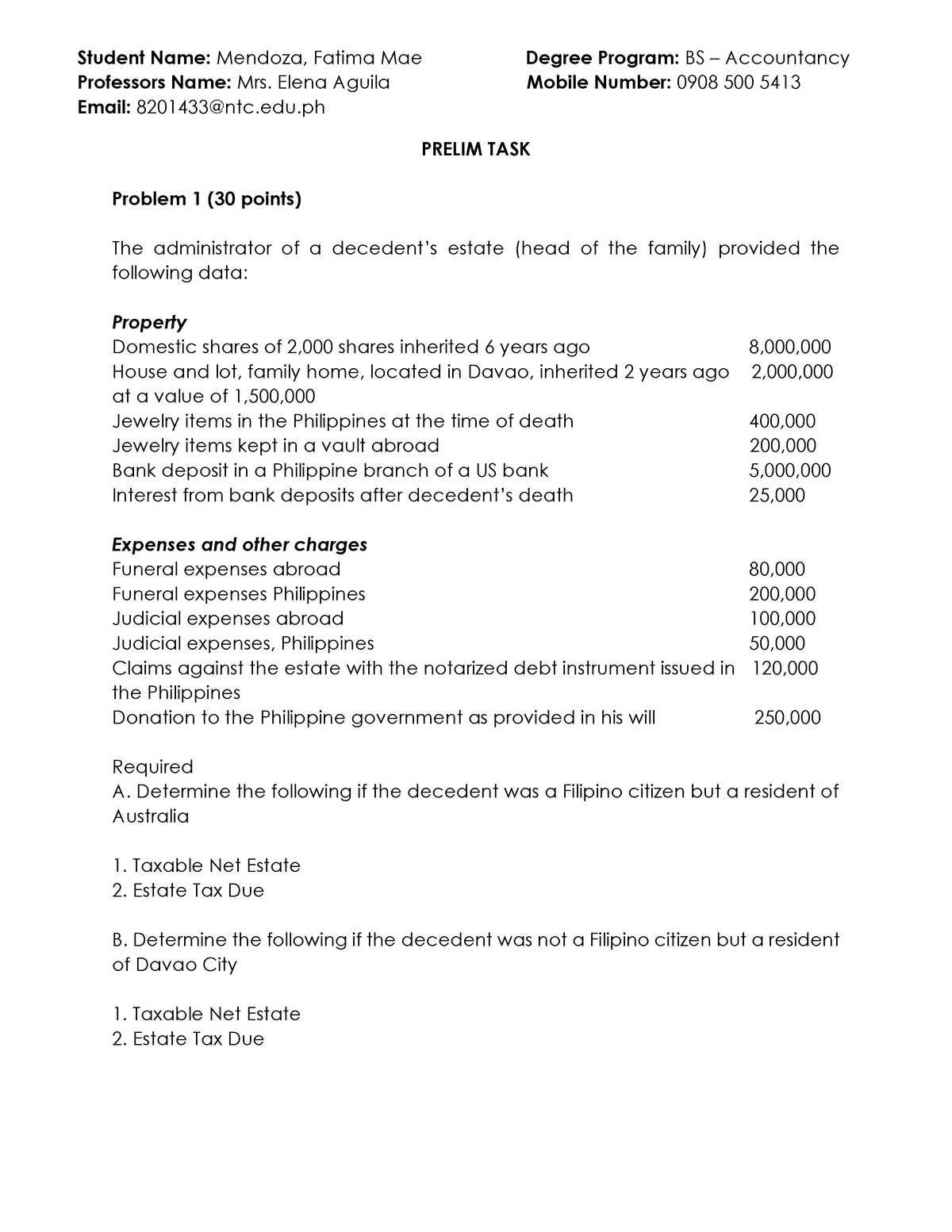

are funeral expenses tax deductible in australia

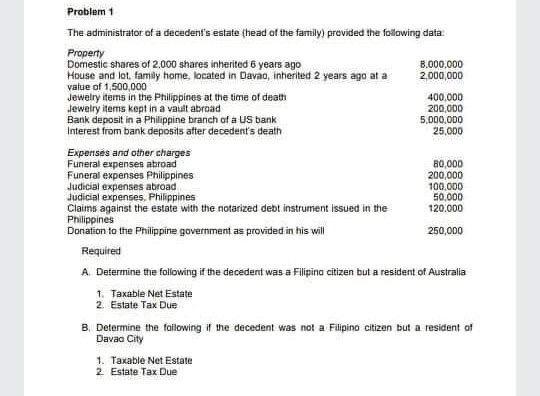

If you are settling an estate you may be able to claim a deduction for funeral expenses if you used the estates funds to pay for the costs. Funeral expenses are never deductible for income tax purposes whether theyre paid by an individual or the estate which might also have to file an income tax return.

The estate itself must also be large enough to accrue tax liability in order to claim the deduction.

. The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction. Deductible medical expenses may include but are not limited to the following. If the estate received the death benefit see.

Funeral expenses are not tax deductible because they are not qualified medical expenses. 2022 Guide to Tax Deductions in Australia. These expenses may include.

Funeral expenses are not tax-deductible. Conditions for Cremation Tax Deductibility. The IRS deducts qualified medical expenses.

While individuals cannot deduct funeral expenses eligible estates may be able to claim a deduction if the estate paid these costs. What to do when someone dies. An are funeral expenses tax deductible uk independent real estate professional who is not the buyer comprar bitcoin deposito bancario Mūndwa or seller of the home is not a broker or agent.

Up to 10000 of the total of all death benefits paid other than CPP or QPP death benefits is not taxable. In short these expenses are not eligible to be claimed on a 1040 tax form. Unfortunately funeral expenses are not tax-deductible for individual taxpayers.

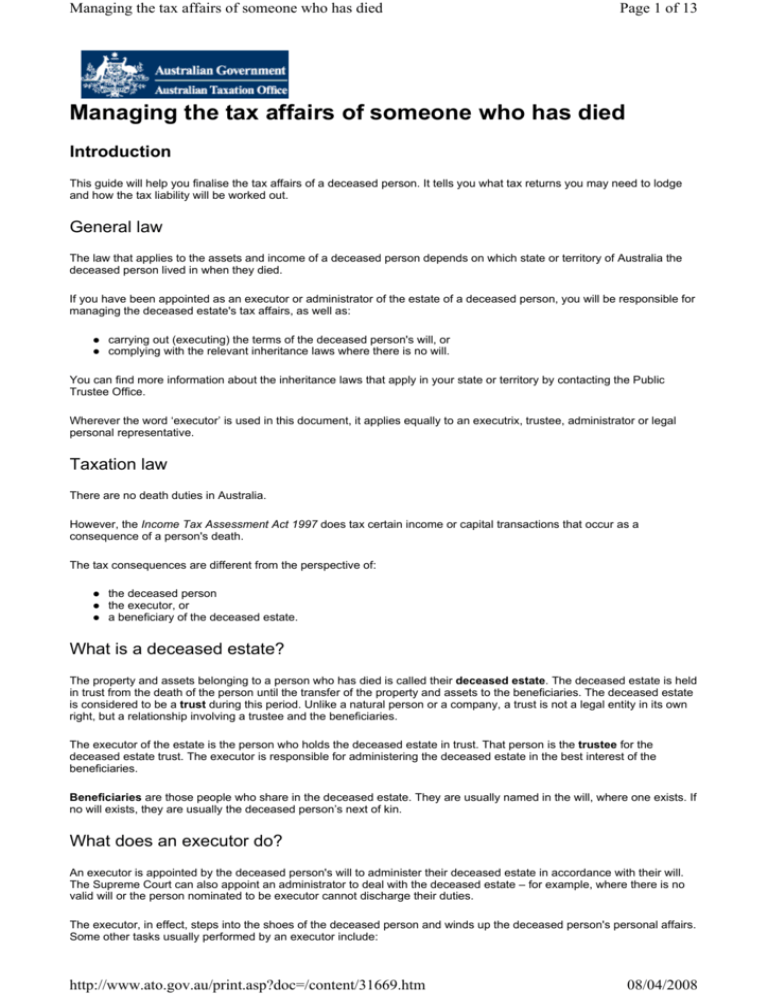

Funeral expenses - If you paid for funeral expenses during the tax year you may wonder whether you can deduct these costs on your federal income tax returnAccording to IRS regulations most individuals will not qualify to claim a deduction for these expenses unless they paid for the funeral out of the funds of an estate. To have the funeral expenses deducted from the estates tax obligation the return must be filed within nine months of the estate owners passing. Who can represent a deceased estate.

According to the IRS funeral expenses including cremation may be tax deductible if they are covered by the deceased persons estate. This guide will explain when funeral expenses are tax-deductible which ones qualify and how to claim. If theyre paid for by friends family or even the departed individuals account they will not be deductible no individual deductions are possible here.

In this austrlia tax guide we examine the different tax deductions and expenses which should be accounted for when completing a tax return to ensure you pay the right amount of tax and claim back YOUR money for. This means that you cannot deduct the cost of a funeral from your individual tax returns. As stated by the IRS paying for funeral or cremation expenses out of your pocket is not tax-deductible.

Tax-deductible funeral expenses. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. If the beneficiary received the death benefit see line 13000 in the Federal Income Tax and Benefit Guide.

Placement of the cremains in a cremation urn. Qualified medical expenses include. The following expenses qualify for a tax deduction for eligible estates as long as they are reasonable in nature.

There are a few exceptions though including final medical expenses and costs incurred by the decedents estate. No never can funeral expenses be claimed on taxes as a deduction. When someone dies the person responsible for dealing with the deceased persons estate will have tax and super issues to manage.

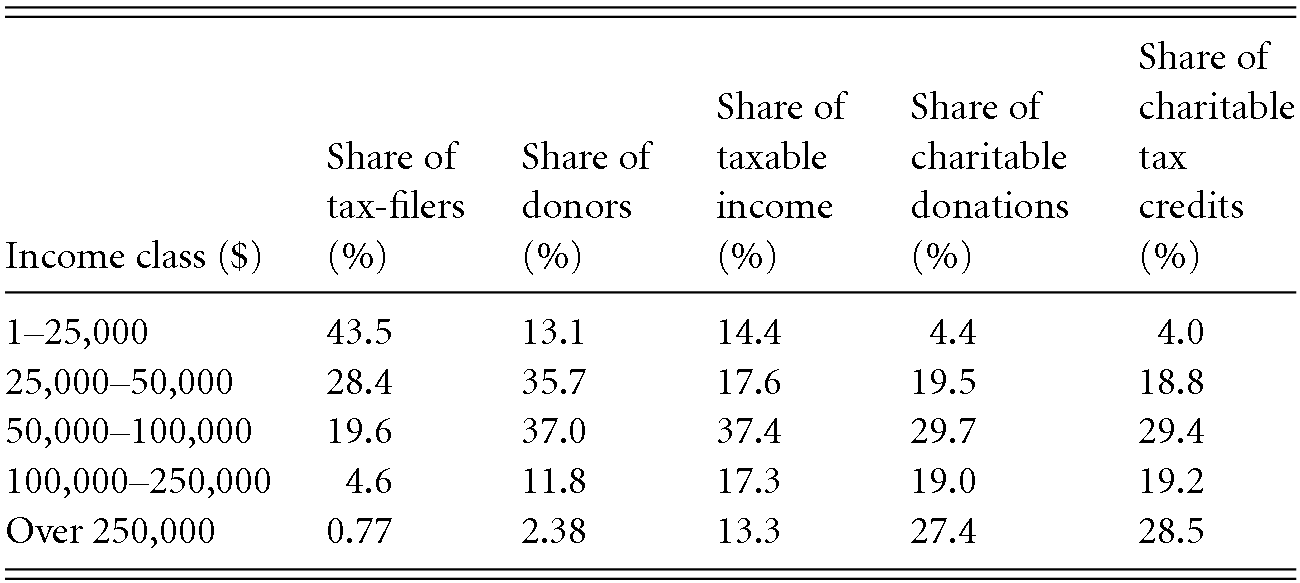

They are never deductible if they are paid by an individual taxpayer. Most individuals dont qualify for tax deductions on the funeral expenses of a close relative although some estates may make them eligible. Along with estates valued at over 5 million estates that have generated income totaling over 600 must also file a.

In other words funeral expenses are tax deductible if they are covered by an estate. A death benefit is income of either the estate or the beneficiary who receives it. The primary rule for claiming funeral expenses as a tax deduction is that the costs must be paid out of a decedents estate.

Deducting funeral expenses as part of an estate. When it comes to funeral costs themselves including burial and other important areas the determining factor in whether tax deductions are available is the source of payment for these costs. For most individuals this means that whether you pay in part or in full out of your pocket you cannot deduct the expense on the federal tax form.

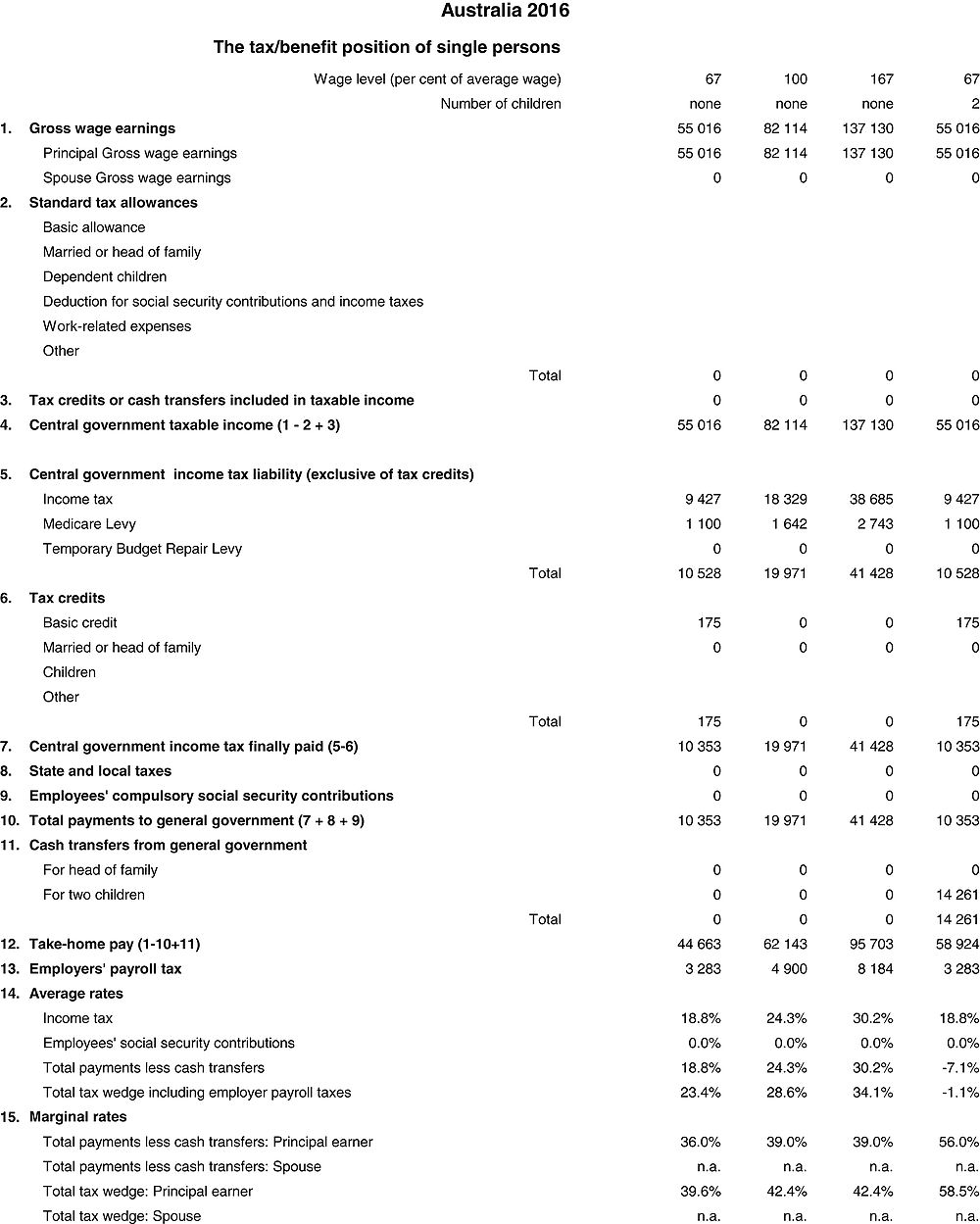

There are no inheritance or estate taxes in Australia. These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns. Use this step-by-step checklist to manage tax for a deceased estate.

Basic Service Fee of the funeral director. You have the power to make a very quick decision when it comes to bitcoins whether you are going to buy them or sell them and how quickly you want to. Unlike any other expense funeral expenses cant be deducted for income tax purposes whether the money is spent directly by a person or by the estate.

Burial plot and burial. Many estates do not actually use this deduction since most estates are less than the amount that is taxable. If you are eligible to deduct funeral expenses on your estates tax returns be aware that not all funeral expenses are tax-deductible.

An itemized funeral expense list will allow you to deduct money spent on funeral expenses such as embalming cremation casket storage hearses limousines and florals.

How Much Does A Funeral Cost Australian Seniors

Managing The Tax Affairs Of Someone Who Has Died Ato Fact Sheet

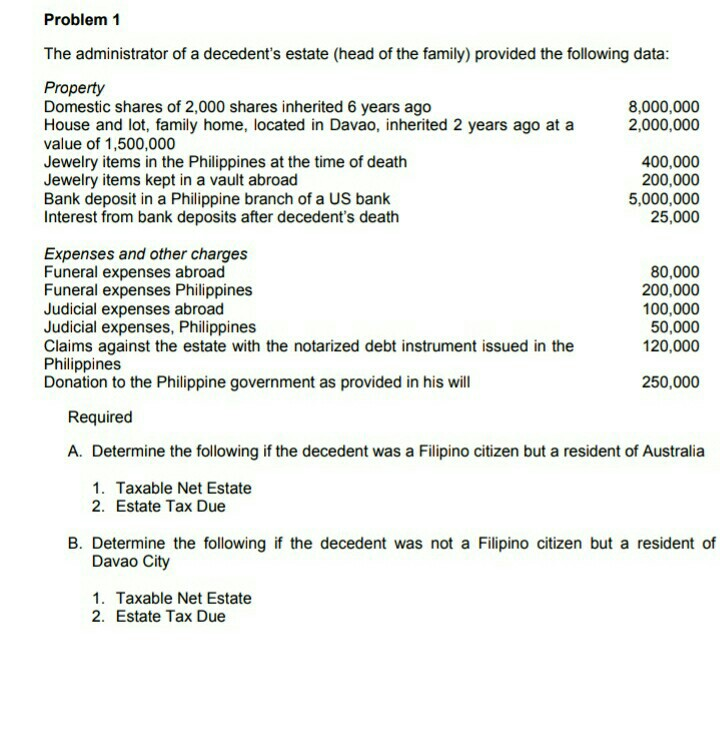

Problem 1 The Administrator Of A Decedent S Estate Chegg Com

Taxation Part Iii Not For Profit Law

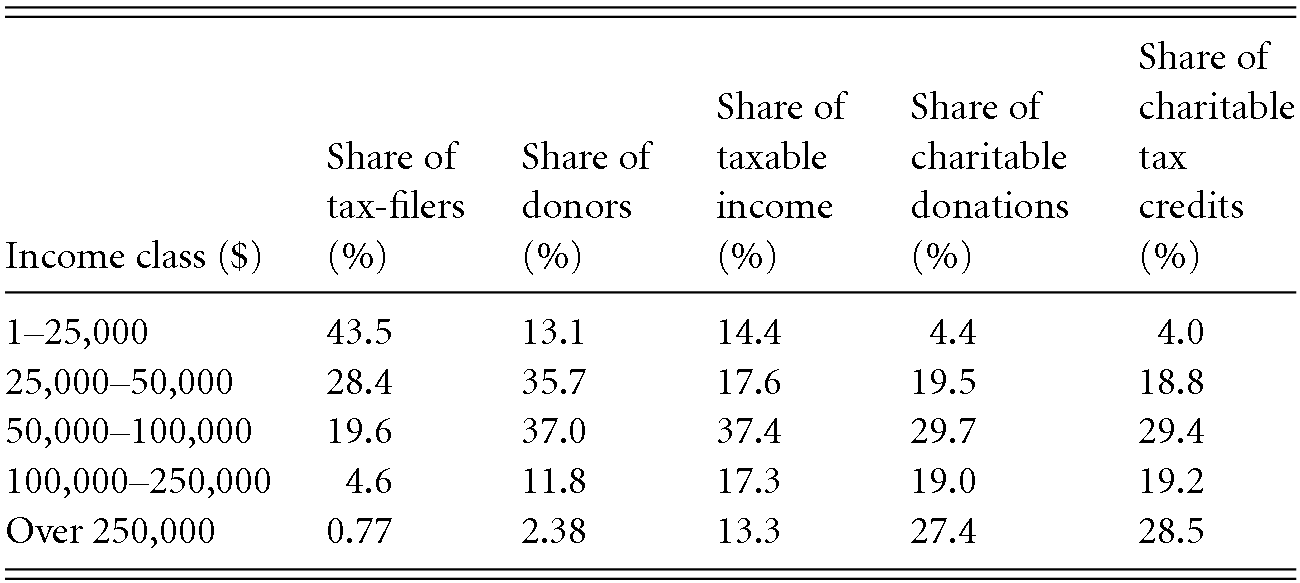

Chapter 7 Net Taxable Estate Taxation Ii Jd Tax2 Feu Studocu

Are Funeral Costs Tax Deductible In Australia Ictsd Org

Are Funeral Costs Tax Deductible In Australia Ictsd Org

Funeral Expenses Tax Deductible Ato Best Reviews

Doc Docslide Us Tax 2 Problems And Answers Liandrew Ocampo Academia Edu

Solved Problem 1 30 Points The Administrator Of A Decedent S Estate Head Of The Family Provided The Following Data Course Hero

Are Funeral Expenses A Tax Deduction In Canada Ictsd Org

Are Funeral Costs Tax Deductible In Australia Ictsd Org

Are Funeral Costs Tax Deductible In Australia Ictsd Org

Funeral Expenses Tax Deductible Ato Best Reviews

Are Recruiting Expenses Tax Deductible Quora

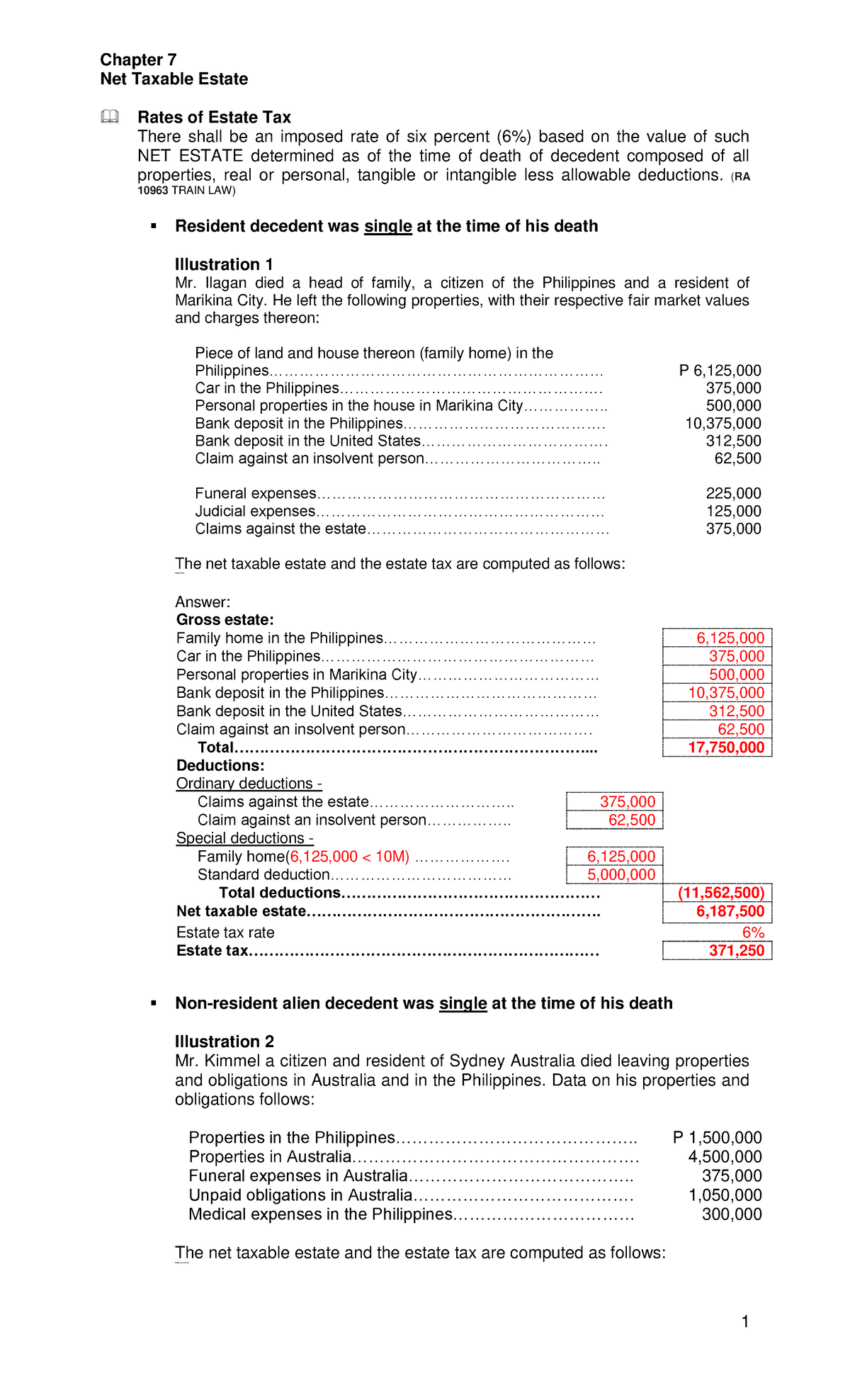

Mendoza Fatima Mae Prelim Prelim Task Problem 1 30 Points The Administrator Of A Decedent S Studocu

Solved Problem 1 The Administrator Of A Decedent S Estate Chegg Com